Every business needs resources to make sure their business is running with optimal results

Empower Your Business Lower Your CostsMaximize Your Success

Dreams Business Resources is the essential partner for businesses seeking optimal results. We not only pinpoint areas of struggle but also connect businesses with top-tier service providers, saving both time and money.

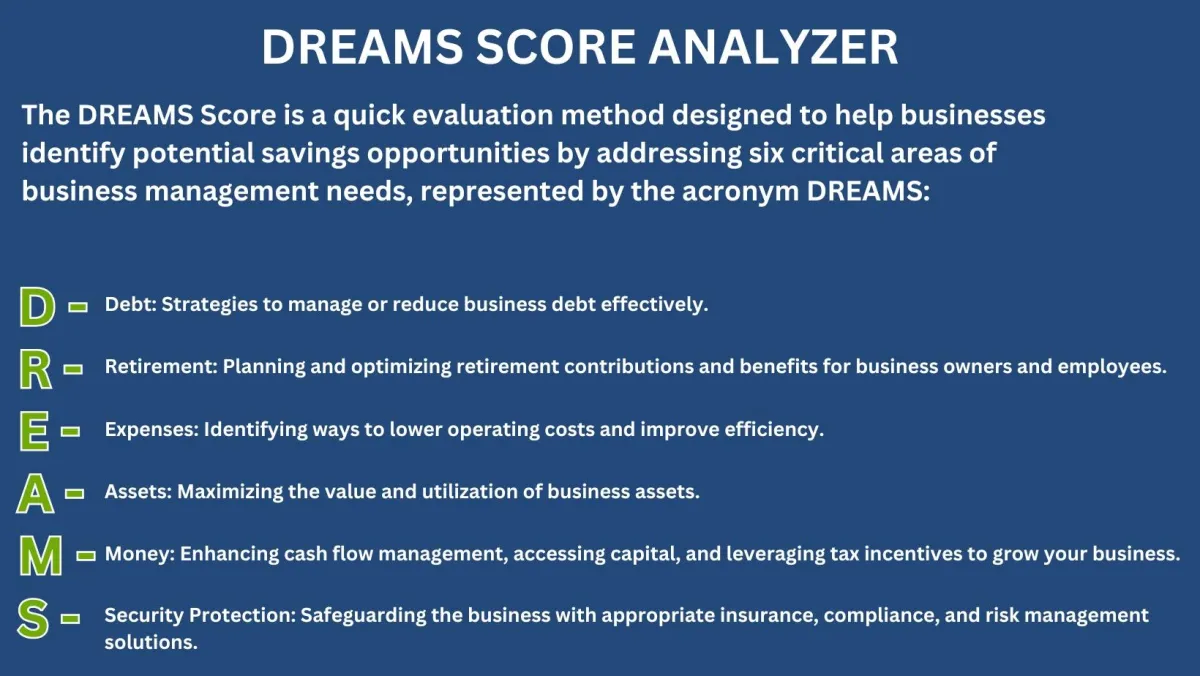

What is DREAMS?

DREAMS is an acrostic we've devised to encapsulate the fundamental elements

essential for constructing a thriving and successful business.

Business Services Beyond Boundaries

Where DREAMS Meet Success

DIGITAL MARKETING

Congressional Legation ERC

The Employee Retention Credit (ERC), also referred to as The Employee Retention Tax Credit (ERTC) was introduced through the CARES Act and the ARPA. This credit is offering up to $21,000 in tax credits per eligible employee for businesses and tax-exempt organizations that had W-2 employees and were affected during the Covid-19 pandemic.

Employee & Business Benefits

Businesses often face management challenges related to employee benefits, payroll administration, risk management, compliance with HR regulations, and talent management. Our innovative technology simplifies the process of managing your most vital asset – your people.

Research &Developmant Tax Credits

Claim your part of the billions of dollars offered each year in government tax incentives for businesses. No industry or business type is excluded, although by the nature of their activities, some are more qualified than others. Numerous lucrative federal and state tax credits and incentives await companies, offering the potential for tax optimization. Only $15 Billion out of the total $100 Billion available was claimed last year. Did You Get YourTax Credits?

R&D TAX CREDITRECENTLY EXPANDED?

Since it was first put in place in 1981, the R&D Tax Credit has gone through a gradual evolution over time, with the most meaningful changes having occurred within the last few years. In 2015, the

Protecting Americans from Tax Hikes Act not only made the R&D Tax Credit permanent, it modified the credit for the benefit of small and mid-size businesses by easing record keeping burden, allowing for the AMT offset and introduction of the startup provision. form of a refund check.

Best Support

We are available 24/7. You can chat with us or make a phone call to discuss your issue

Professional Agents

Our staff combined experts in all classes of insurance you can afford today.

The Best in North America

According to the professional analytic center, we are the number one company in this region.

2025©Copyright | Dreams Resources All Right Reserved